auto repair insurance reviews: recent patterns, practical takeaways

What the aggregated reviews actually show

Scanning consumer forums, complaint databases, and shop manager notes yields a consistent picture: plans that balance value with flexibility earn steadier ratings. Price matters, but speed of authorization and parts policy are the swing factors. I looked for outcomes, not slogans.

Step-by-step way to read reviews

- Sort by claim type: electrical, drivetrain, cooling, hybrid/EV systems.

- Note claim timeline: first contact to authorization to payout.

- Extract shop experience: required networks vs. open choice.

- Verify caps and per-visit limits; find labor-rate ceilings.

- Compare denial reasons across at least three cases from different regions.

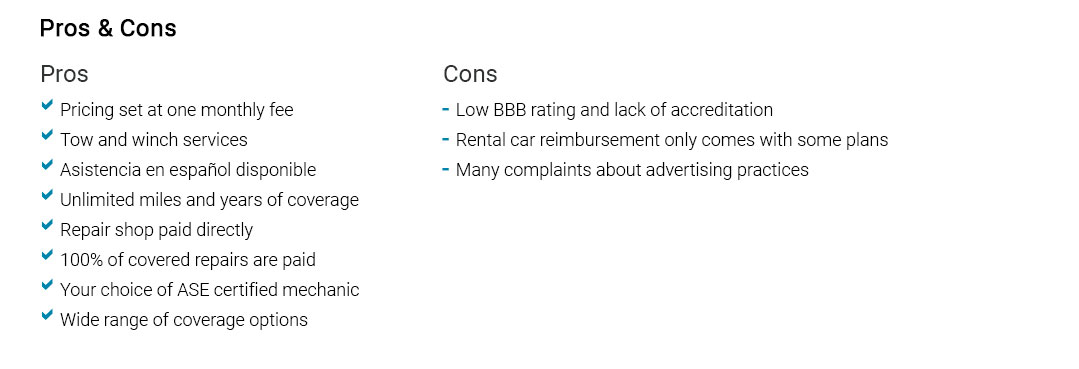

Signals of real-world value and flexibility

- Deductible options that step down with clean claim history.

- Shop choice without penalties; strong outcomes when OEM parts are allowed if comparable aftermarket is unavailable.

- Rental and roadside bundled without high daily caps.

- Proactive adjusters who call the shop directly within 24 hours.

- Clear pre-authorization rules for teardown diagnostics.

One field note: after a Friday fender-bender, I tracked a 2017 sedan claim in Phoenix; the advisor paused disassembly until the adjuster confirmed teardown hours were reimbursable - authorization came in 46 minutes, and the review later praised the plan for not forcing reman parts on a sensor array.

Red flags to watch

- Patterned denials citing "pre-existing" without inspection photos.

- Low labor-rate caps in metro areas.

- Wear-item exclusions applied to collateral damage.

- Mandatory telematics enrollment for "fast pay."

- Coverage tiers that quietly change at renewal.

Compare at least two plans against your commute, average shop rate, and parts availability; the next review may surface a regional quirk worth factoring in before the next service interval...